📊 Business & Tech

- If what you do succeeds, will the world be better?

- Whose money do they have to take to stay in business?

- What do you have to believe to think that they’re going to succeed? In what way does the world have to change or not change?

- Do you have evidence of leaders in the organization making hard choices to do the right thing?

- Does your actual compensation take care of what you need for all of your current goals and needs — from day one?

- Is the role you’re being hired into one where you can credibly advance, and where there’s sufficient resources for success?

🚕 If you use a rideshare app in NYC, the latest NBER study may save you $:

Among consumers who opened either the Uber or the Lyft app on a given day, only 16 percent opened the other. The report found that the average absolute price gap between Uber and Lyft was approximately $3.50, representing roughly 14 percent of the average fare price, with higher gaps for longer rides. Price differences exceeded $1 about 75 percent of the time, and the distribution of price gaps was relatively symmetric, meaning neither platform was consistently cheaper. NYC riders collectively forgo approximately $300 million in potential annual savings by not comparing prices between platforms. Consumers may benefit from comparing prices more regularly. The market could also become more competitive if there were increased access to price aggregators, reducing search frictions.

In sum—check Lyft and Uber before booking a ride.

🗞️ The latest dispatch from Mercury’s Playbook, my business/tech newsletter, is out now: mercurysplaybook.com

For this essay, I discuss the trend taking place in modern markets toward “winner-takes-all” conditions, why some AI superstars are being paid pro athlete money, and much more.

💼 Anil Dash’s questions for knowing if that job will crush your soul:

Co-signing the entire post.

🤣 At the intersection of tech and business

📊 Matt Stoller published a very insightful warning on potential anti-trust issues with the WBD acquisition by Netflix. However, I am not entirely convinced of his argument, which seems to neglect the drastic change in how audiences consume content, the value most people find in Netflix, and the intensity of competition in the streaming space (most people don’t have $ for all of them and find the multiple subscription model very fatiguing). Nonetheless, it’s worth the read and I will be chewing on the data for a bit.

🌲🏢 Yesterday, I learned that REI closes on Black Friday and pays their 14,000+ employees to spend time outdoors and in nature instead. It’s called #OptOutside and it is not an insignificant gesture by the brand. Much respect!

Thanks to @jinscho for bringing it to my attention.

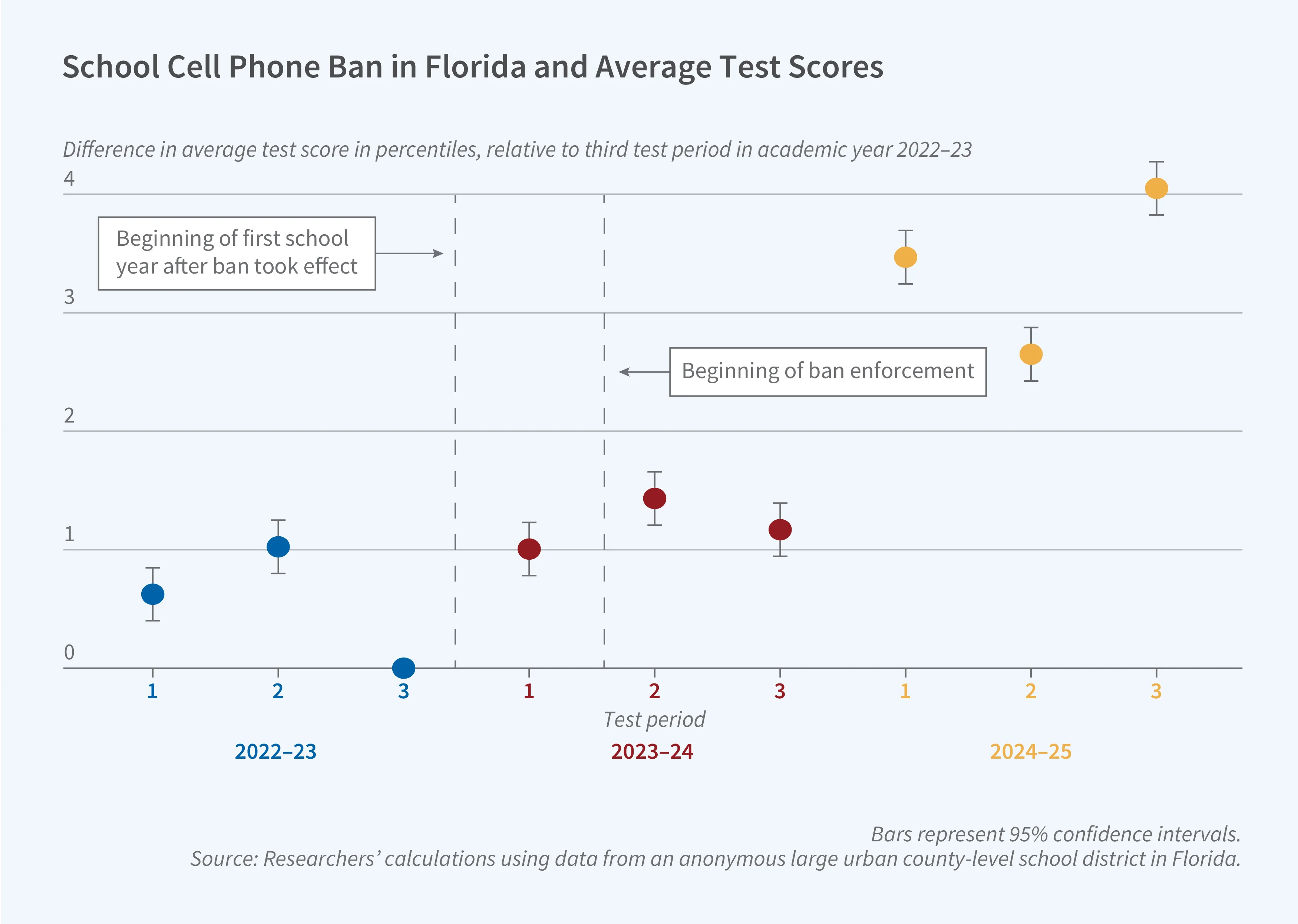

📵 A new paper in NBER found that two years after the imposition of a student cell phone ban, student test scores in a large urban school district were significantly higher than before.

Most intriguing is that there was a period of “withdraws” during which disciplinary actions rose before adjusting.

📉 A favorite professor of mine is raising the alarm regarding “Buy Now, Pay Later” providers, who are in for serious disappointment if/when the economy contracts. It’s mind-boggling that such tenuous and sketchy models of financing are allowed in 2025.